Over the past twenty five years we have had the opportunity to work with numerous high net worth wealth advisors and their clients. While investment strategies and resources can vary greatly from firm to firm asset allocation remains the cornerstone to a successful investment strategy. However, understanding and incorporating private company ownership within an investment strategy is an area that can challenge even the most sophisticated wealth advisor.

A Hidden Flaw in Asset Allocation

I relish the opportunity to learn how our HNW partners strive to serve their clients and have appreciated the opportunity to sit in on executive sessions that address firm-wide strategies, investment policies, and best practices. Technology, access to information, and global market dynamics continue to change the investment advisory landscape and the best advisors continue to evolve. Advisors must foster deeper relationships with clients to remain competitive and provide increasingly sophisticated diversification strategies that account for risk tolerance and time horizon. A good advisor that stays focused on these principles can be worth their weight in gold (at today’s spot a 200 lb. advisor is worth over $3.7 million, before tax).

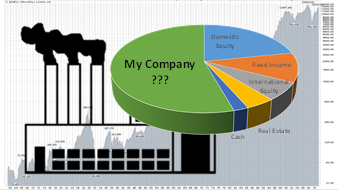

However, we encounter a fatal flaw in many investment strategies: ignoring or overlooking the nuances of the private company asset. Many high net worth clients build their initial wealth through growing a profitable business. Empirically, few entrepreneurs (and fewer wealth advisors) have a solid handle on the marketability, volatility, and valuation of that business. An otherwise well-crafted investment strategy that relies on a less than optimal assessment of marketability, or ignores specific company characteristics, will undermine any application of modern portfolio theory.

The Private Company as an Asset Class

Including some assessment of private company ownership (as well as other tangible and intangible investments) has become standard practice in all asset allocation models. In many instances the Company is the single largest asset in a portfolio. Yet the level of detail and analysis around this asset class can be grossly deficient or entirely overlooked. Large wire houses and successful RIA firms compete on the strength of their access to and understanding of the various asset classes employed in a well-diversified investment strategy. But few firms have the in-house resources, knowledge, or capability to adequately understand and view the private company as an asset class within the broader investment strategy.

Instead wealth advisors are forced to default to “self-appraisal” (…worth about $50 million), estate planning valuations (seldom indicative of true market value), or rudimentary metrics (e.g. EBITDA multiples). In fact, private company valuations are much more complex. Some companies are valuable but not saleable. Others have opportunities to enhance value greatly with some simple housekeeping. And some can be worth far more than anticipated due to current private equity or market trends, which could accelerate the time to liquidity.

Key Factors to Consider

There are numerous issues to consider when approaching the concepts of the marketability and value of a private company asset, such as:

- Revenue visibility and customer contracts;

- Earnings volatility and reliance on key raw material inputs;

- Customer or geographic concentration;

- Management succession;

- Tax efficiency;

- Capital expenditure requirements; and

- General industry and private equity dynamics.

Establishing an understanding of the asset requires experience and diligence in order to derive its correlation with other asset classes, sensitivity to macro-economic events, and ultimately how it integrates within a broader investment strategy.

Working with Your Investment Banking Partner

One of the most exciting aspects of advising privately held business owners is that no two companies are alike. A good investment banker requires decades of experience to grasp the nuances of a company and its appeal (i.e. value) in the market. Considering the private company as a discrete asset class and integrating this approach within the broader investment strategy improves the efficient market frontier of a portfolio, enhances the Company value over time, and solidifies the advisors relationship with the client.