Business owners have had more than enough to think about already in 2020. Needing to quickly adjust to COVID-19 challenges, managing a remote workforce, or pivoting strategy on a dime has challenged many leaders in a few short months. With business triage now behind us, many owners have started looking towards the future and reassessing their priorities and long-term objectives. A presidential election, the largest stimulus package our country has ever provided, and national debt that is now greater than 100% of GDP create an expectation that tax rates could go up in the foreseeable future.

While not much is available from the current administration on potential tax changes, the Biden campaign has shared two key components of its proposed tax plan. The top tax bracket for ordinary income could increase from 37.0% to 39.6%, the same level as when Biden was vice president. There is also a proposal to nearly double the capital gains tax rate from 20.0% to 39.6% for income over $1 million. While not a concern for many Americans invested in the public markets, this will have a drastic impact on business owners pursuing a liquidity event, especially those businesses that are structured as pass-through entities where the business income flows to the owners. Helping family- and founder-owned businesses assess sale timing is always a focus of ours, but this proposed change has a material impact on that analysis until a new tax code goes into effect.

For the purpose of this illustrative analysis, we will take a fictional company generating $50 million of revenue growing at 10% every year, a consistent 20% EBITDA margin, and a static 10x EBITDA multiple to help quantify the impact of delaying a sale until after a change to the tax code. To simplify the analysis, we have assumed $0 basis in the business, no transaction costs, and the business is a pass-through entity, so income is well over the million-dollar threshold.

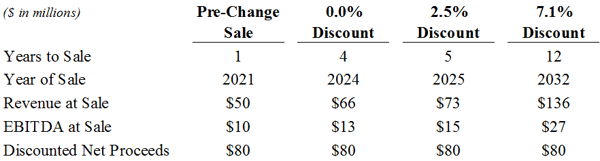

Impact of Delaying a Sale: 0% Discount Rate

Our first analysis will look solely at net proceeds, assuming no state or local tax, and no discount for time-value or some other risk-adjusted discount rate. In Year-0, the Company would generate $10 million of EBITDA at a 10x multiple for $100 million of enterprise value. The shareholders then pay 20% tax and net $80 million. Under Biden’s assumed proposed tax code, it would take the owners two years and eleven months of growing at a constant 10% per year to return to the same $80 million net proceeds. Over that time, they continue to take on economic risk, execution risk, and market risk. Therefore, we should add a discount rate to capture these risks assumed by postponing a liquidity event.

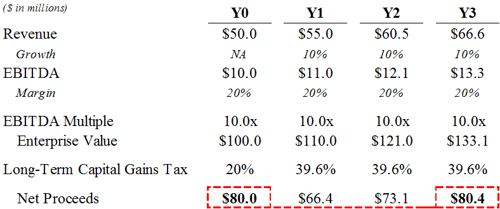

Impact of Delaying a Sale: Inflation Adjusted 2.5%

One approach to analyzing a risk-adjusted time to breakeven is to discount the future value at a measure of inflation, in this case 2.5%, so the real net proceeds in the future are the same as today. Taking the same analysis as above, we add a final step of calculating the present value of the net proceeds. Using the 2.5% discount rate, the breakeven time increases from two years and eleven months to three years and eleven months.

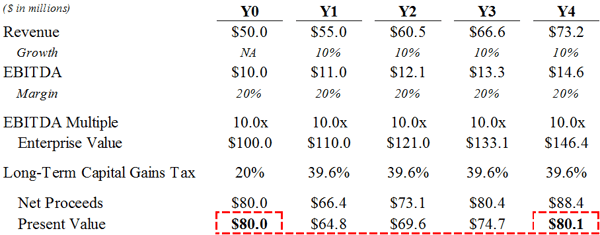

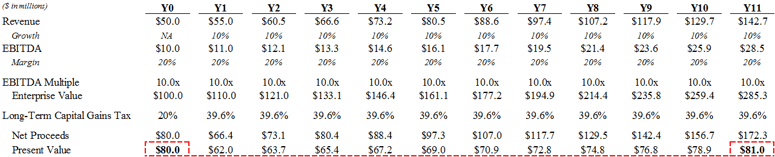

Impact of Delaying a Sale: Market Return 7.1%

Our final approach analyzes our fictional company using an opportunity cost discount rate. That is, to discount the future value at the long-term market return rate. For this analysis we used Vanguard’s long-term 30% stock / 70% bond portfolio return of 7.1%, a conservative asset allocation. Using our original set of assumptions, if the shareholders have a 7.1% required rate of return, it would take ten and a half years for the shareholders to reach a point of indifference on a net proceeds basis.

Conclusion

There is so much more that goes into the decision of whether or not to sell a business than just the net proceeds. There are numerous personal and professional considerations. However, when we look at it from a purely financial perspective, if a business owner was thinking of pursuing a transaction in the next 3-5 years, then now is the time to start the process to provide the best opportunity to complete a transaction and remove the risk of a changing tax code. Being early by a day is fine, but one day late could cost you tens of millions of dollars.