Much has been written recently about the new tax code and impact it could have on M&A. I have read over a dozen articles that all start the same way:

- Corporate tax rate is declining from 35% to 21%

- Corporate alternative minimum tax is repealed

- One-time repatriation at a lower tax rate will be permitted

- Immediate depreciation of new and used assets

Many of these articles then conclude that these larger expected corporate cash balances will persuade managers and boards of directors to immediately pursue additional acquisitions, and 2018 will be a another record M&A year. Don’t get me wrong, 2018 is looking to be a strong year for M&A and the authors of the previous articles have the right conclusion, but maybe the wrong premise. We believe that 2018 will be a robust M&A environment for strategic acquirers, but the foundation was laid two years ago, not by the tax bill.

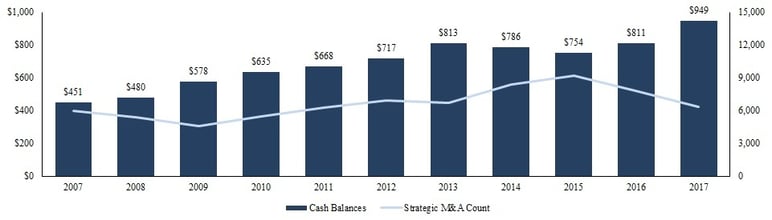

Corporate cash balances, as represented by the S&P 500, have steadily grown over the past ten years from $451 billion to $949 billion in 2017 (see chart below). If annual M&A volume was driven by expected year-end cash balances, as suggested by many recent articles, we would expect to see a high correlation, at least directionally, between cash balances and the number of M&A transactions. However, what we see is that over the ten years, only three years do cash balances and M&A volume move in the same direction. This 30% directional correlation suggests that corporate managers and boards are not making M&A decisions based on expected cash balances.

2007-2017 Corporate Cash Balances and Strategic M&A Volume

($ in billions)

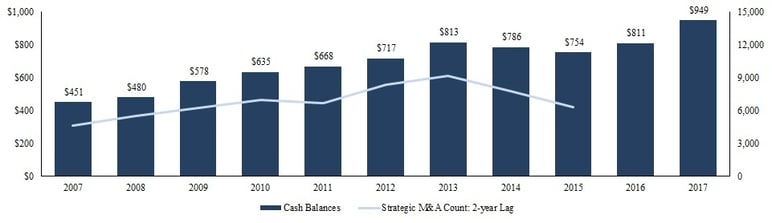

However, when we look at a two-year delay between the movement of cash balances and M&A volume, we see a much stronger correlation (see chart below). In seven out of the eight years, M&A volume and cash balances move together.

To us, this suggests the following narrative: corporations, after experiencing an influx of cash, need time to set strategy and identify potential targets. Once targets are identified, the negotiation, diligence, and closing processes can commence. This whole process can take 18-24 months.

2007-2017 Corporate Cash Balances and Strategic M&A Volume, Lagged Two Years

($ in billions)

Yes, we agree that if we look only at cash balances, it would suggest the M&A volume in 2018 will increase over 2017. Where we disagree is the cause. The increase in 2016 corporate cash balances will be a larger driver in 2018 than the increase in cash balances as a result of the new tax code. Our analysis suggests that 2019 strategic M&A volume should increase over 2018 based on the record cash balances achieved in 2017, and the impact of the 2018 tax code on M&A volume will be seen in 2020.

Where the new tax code will have immediate impact is on M&A valuation. But that is another article for another day.